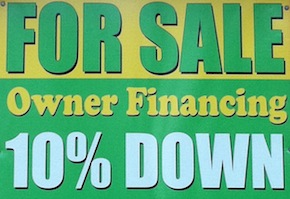

Owner financing has once again gained popularity as mortgage approvals prove hard to obtain. The installment sale is being pulled out of the toolbox as an alternative financing method to conventional loans.

Owner financing has once again gained popularity as mortgage approvals prove hard to obtain. The installment sale is being pulled out of the toolbox as an alternative financing method to conventional loans.

As the owner financing method becomes a frequent topic among real estate agents, investors, and discussion boards there are inevitably some misconceptions being perpetuated. These three myths seem to continually reoccur:

MYTH #1 – The Seller Must Own Property Free and Clear to Offer Owner Financing

FACT: While zero existing debt on a property can be an advantage in seller financing it is NOT a requirement. In fact, the majority of owner-financed transactions have a prior debt incurred by the seller from when they bought the property. When the seller offers financing and this mortgage remains it is commonly known as a “Wraparound Mortgage” or “All Inclusive Trust Deed (AITD)”.

As the buyer makes payments to the seller on the new owner financing the seller must in turn continue to keep payments current with their lender. This type of arrangement comes with risk, including a senior mortgage holder calling their note all due and payable for violation of the due on sale clause. While many lenders are happy to receive timely payments it is important to consult with an attorney to understand or minimize risk.

MYTH #2 – Seller Financing Just Involves FSBO Deals

FACT: – A portion of seller financed notes are created from For Sale By Owner (FSBO) transactions but there are equally as many sellers using the services of a Real Estate Agent. Experienced agents will often encourage sellers in slow markets to include “Owner Will Finance” in the MLS property listings.

These agents are still paid their commission at closing from proceeds, generally from the down payment funds. In the rare cases there are not sufficient proceeds to cover the commission at closing some agents have elected to take back a note themselves for a portion of their fee.

MYTH #3 – There Are Only Second Liens With Seller Carry Back Financing

FACT: The majority of seller financed notes sold to investors for cash on the secondary market are NOT second liens. If the seller wrapped an existing mortgage and still owes money the note investor will pay off the seller’s debt at closing from the note purchase proceeds. This puts the seller-financed note in first position.

There are also many second liens created from some version of the 80-10-10 transaction. This is where the buyer puts 10% down, obtains an 80% bank loan the seller carries back the 10% remaining balance as a second lien. The buyer’s new bank loan is in first position and the seller is in second position.

These small second position notes are highly risky transactions, especially in a falling real estate market. Many note investors decline to purchase a small second due to the high risk of default on a low equity high LTV subordinate lien.

Recognizing these common misconceptions and their myth busters will help sellers, investors, brokers, and buyers put seller financing to good use during the sub prime mortgage meltdown.

If you would like a free note analysis we invite you to contact us!